Understanding Cashbacks

Cashback, effectively a reward or incentive, is primarily used by credit card companies to encourage consumers to make purchases on credit more often. A cashback feature on a credit card allows the cardholder to earn a percentage (ranging typically from 0.25%-5%) of eligible spend. For example, American Express’ SimplyCashTM Preferred Card offers a 2% cashback on all purchases made on the card.

The following are the most common forms of cashback:

- Flat rate cashback: Receiving a flat rate cashback, regardless of spend type. An example would be the previously outlined American Express’ SimplyCashTM Preferred Card, which has a flat 2% cashback rate.

- Tiered rate cashback: A tiered cashback rate depending on annual spending. For example, a 0.5% cashback rate if annual spend is below $5,000 and a 1% cashback rate if annual spend is above $5,000.

- Different rate cashback (depending on the type of spend): This form of cashback has different rates depending on where the money is spent. For example, supermarket spend may have a 1% cashback; fuel spending may have a 3% cashback, etc.

In a few instances, the cashback amount is subject to an annual cap. It is important to read the fine print behind your credit card.

Redeeming Cashback

Readers should note that some cashback credit cards require a minimum redemption threshold. Again, it is important to read the fine print behind your credit card. Depending on the credit card terms, the cashback is generally redeemed through the following:

- Bank deposit: The cashback is deposited directly to your checking or savings account.

- Credit on statement: The cashback directly offsets your current credit card balance. For example, if your credit card balance is $100 and the cashback is $2, the applicable payment amount on your statement would be $98.

- Gift card: The cashback is returned in the form of a gift card for use at retailers.

How Do Credit Card Companies Make Money From Cashback?

Without a doubt, cashback provides cost savings for consumers when they make eligible purchases. However, how does cashback benefit the credit card company?

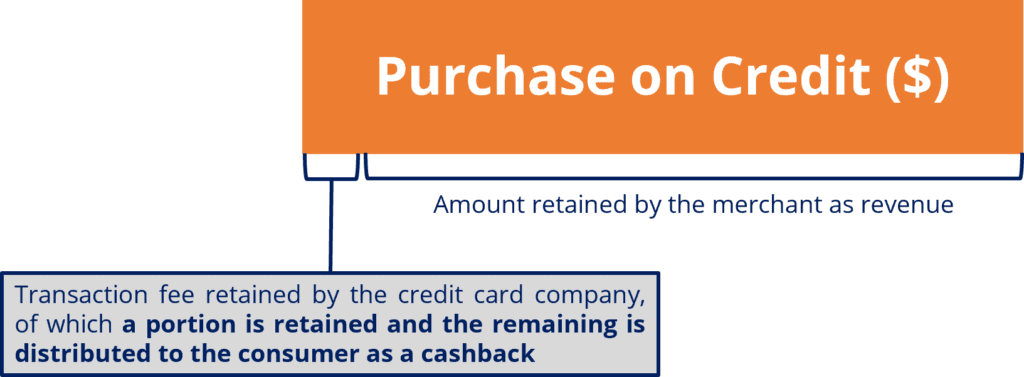

In a cashback transaction, the credit card company would share a portion of the transaction fee (typically around 2%) generated from the merchant with the consumer. This is illustrated below:

Although it may appear that the credit card company is losing money on a cashback transaction, that is not necessarily true. First, it is useful to recall the business model of credit card companies. Credit card companies generate a small transaction fee from merchants when consumers use their credit cards.

As a result, credit card companies provide cashback on their credit cards to incentivize consumers to use their credit card (which generates fees for the company) more often over cash or debit card (which does not generate fees for the company).

Furthermore, consumers may overspend on their credit cards due to the attractiveness of the cashback, providing greater interest payments for credit card companies from overdue payments. Lastly, credit cards with cashback may have an annual fee, providing additional revenue for credit card companies.

Example of Cashback

Background Information: Tim is an individual who predominantly pays via debit card or cash over credit card to avoid having to remember to pay off the outstanding credit card balance each month. Recently, He signed up for a credit card solely for the cashback, which is 2% and eligible on all purchases.

Question 1: Over a one-year period, Tim made $15,000 in purchases on the credit card. Assuming a 3% transaction fee charged by the credit card company to merchants, what is the net revenue generated by the credit card company?

Answer: With $15,000 in purchases on the credit card, the transaction fees collected from merchants by the credit card company total $450 ($15,000 x 3%). With a 2% cashback, the credit card company shares $300 ($15,000 x 2%) with Tim, resulting in a net revenue of $150.

Question 2: How has the credit card company benefited from offering Tim cashback on credit card purchases?

Answer: Tim predominately pays via debit card or cash. As such, by offering a credit card with cashback, the credit card company has incentivized Tim to purchase more on the credit card. As a result, the $15,000 in purchases that would have been made on a debit card or with cash is now on the credit card, generating net revenue of $150 for the credit card company.

Things to Keep in Mind as a Consumer

- Getting a cashback credit card may tempt you to spend more than you normally would just to earn cashback. It is important to keep your spending habits in check, as the extra cashback generated from overspending could easily be outweighed by additional interest charges from being unable to pay off the credit card balance each month.

- It is important to read the fine print of each cashback credit card. If there is a cashback limit and an annual credit card fee, this will reduce the attractiveness of the cashback. For example, if we assume an extreme scenario of a $500 annual cashback limit and a $400 annual fee, the maximum that a consumer can save from using a cashback credit card is only $100.

Additional Resources

To keep learning and developing your knowledge base, please explore the additional relevant resources below: